property taxes las vegas nevada records

Below you will find an example of how to calculate the tax on a new home that does not qualify for the tax abatement. Marriage License.

Las Vegas Nevada S Biggest Real Estate Deals See No Transfer Taxes

At this stage it may make sense to get help from one of the best property tax attorneys in North Las Vegas NV.

. Selling a 300000 house for instance generates a transfer tax bill. See the recorded documents for more detailed legal information. Search Homes Our Team Our Agents Las Vegas Communities Housing Information Blog Contact Search Homes Our Team Our Agents Las Vegas Communities.

You may find this information in Property Tax Rates for Nevada Local Governments commonly called the Redbook. Carefully determine your actual real property tax including any tax exemptions that you are qualified to have. Certain Tax Records are considered public record which means they are available to the public.

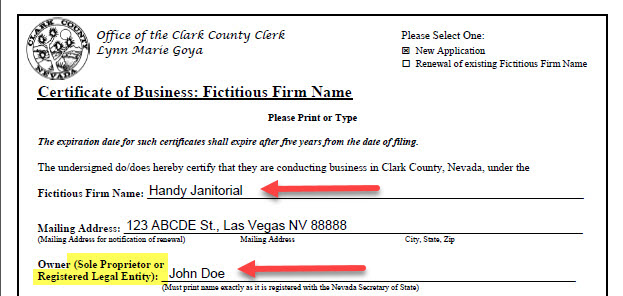

Tax Records include property tax assessments property appraisals and income tax records. 111-11-111-111 Address Search Street Number Must be Entered. Get Property Records from 2 Building Departments in Las Vegas NV.

Ad 1Search Any Address 2Find Property Records Deeds Mortgage Much More. Facebook Twitter Instagram Youtube NextDoor. See Property Records Tax Titles Owner Info More.

Nevada Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in NV. Smaller counties and cities may maintain their own public record databases. Occasionally some Assessor files are.

1351 Water Lily Way Las Vegas NV 89142. 1381 Water Lily Way Las Vegas NV 89142. Make Personal Property Tax Payments.

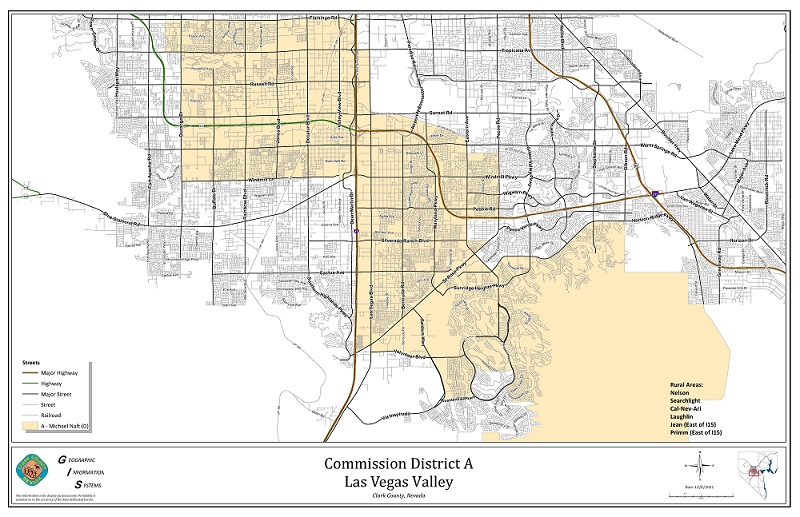

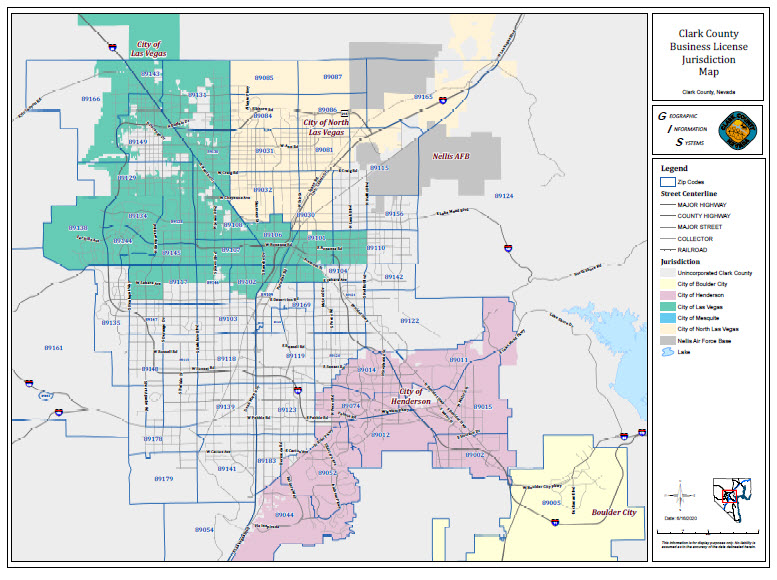

Clark County and the city of Las Vegas maintain public record databases for various types of information. City of Las Vegas Property Search. Show current parcel number record.

Thoroughly compute your actual property tax including any tax exemptions that you are allowed to use. The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000. Then question if the size of the increase justifies the time and effort it requires to challenge the valuation.

The average property on Shadwell St was built in 2006 with an average home value of 66838. You can also obtain the Road Document Listing in either of the. 1264 S Rainbow Blvd Las Vegas NV 89146.

Public Property Records provide information on land homes and commercial properties in Las Vegas including titles property deeds mortgages property tax assessment records and other documents. Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes. 1471 S Rainbow Blvd Las Vegas NV 89146.

You must have either an 11-digit parcel number or the recorded document number to use the Road Document Listing transaction. 1283 S Rainbow Blvd Las Vegas NV 89146. Select an address below to learn more about the property such as who lives and owns.

Or Company Name Last Name Required. Road Document Listing Inquiry. When going to court property owners usually order service of one of the best property tax attorneys in Las Vegas NV.

Treasurer - Real Property Taxes. Parcel TypeBook Page. What is the Property Tax Rate for Las Vegas Nevada.

The average price for real estate on Westlund Drive is 55843. Online Property Records Information At Your Fingertips. Las Vegas Planning Department 333 North Rancho Drive Las Vegas NV 89106 702-229-6301 Directions.

Home Government Assessor Real Property Property Search Real Property Records. Parcel inquiry - search by Owners Name. Search Any Address 2.

We found 38 addresses and 38 properties on Westlund Drive in Las Vegas NV. Las Vegas Property Taxes - how to calculate property taxes in Nevada and how to learn more. Make Real Property Tax Payments.

Search the City of Las Vegas property assessment records by parcel number owner name or street name. Account Search Dashes Must be Entered. Access to Market Value Estimates Deeds Mortgage Info Even More Property Records.

Total Taxable value of a new home 200000. Property Account Inquiry - Search Screen. 1371 Water Lily Way Las Vegas NV 89142.

Information on roads and other right-of-way parcels may be obtained by one of the links under the Road Document Listing. Ad Find Nevada County Property Tax Info For Any Address. Tax bills requested through the automated system are sent to the mailing address on record.

Please verify your mailing address is correct prior to requesting a bill. Las Vegas Building Department 731 South 4th Street Las Vegas NV 89101 702-229-6251 Directions. The average lot size on Shadwell St is 2436 ft2 and the average property tax is 2Kyr.

City of Henderson Property Search. Grand Central Pkwy Las Vegas NV 89155. The average property tax on Westlund Drive is 1829yr and the average house or building was built in 1961.

What seems a large increase in value may only produce an insignificant boost in your tax payment. The Assessor parcel maps are for assessment use only and do NOT represent a survey. 32 properties and 32 addresses found on Shadwell Street in Las Vegas NV.

Check here for phonetic name match. In Nevada the market value of your property determines property tax amounts. NRS 3614723 provides a partial abatement of taxes.

Tax Records include property tax assessments property appraisals and income tax records. Tax Rate 32782 per hundred dollars. Several government offices in Las Vegas.

Assessment Ratio 35. Once every 5 years your home is required to be re-appraised by County Assessors. You can expect to see property taxes calculated at about 5 to 75 of the homes purchase price.

123 Main St City State and Zip entry fields are optional. Search City of Henderson property assessment records by parcel number owner name or street address. Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More.

This may include tax assessor appraiser collector records deeds lien county clerk and land records. Up to 38 cash back Get more information on Nevada property tax records. 1 day agoIn Clark County transfer taxes make up a fraction of a propertys purchase price amounting to a tax rate of 051 percent.

Las Vegas Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Las Vegas Nevada. The Assessor parcel maps are compiled from official records including surveys and deeds but only contain the information required for assessment. Counties in Nevada collect an average of 084 of a propertys assesed fair market value as property tax per year.

If real property is purchased during the fiscal year or if a mortgage company is no longer responsible for making tax payments call our office to request a bill at 702-455-4323. 1467 S Rainbow Blvd Las Vegas NV 89146. A Las Vegas Property Records Search locates real estate documents related to property in Las Vegas Nevada.

Nevada is ranked number twenty four out of the fifty states in order of the average amount of property taxes collected. Apply for a Business License. The average household income in the Westlund Drive area is 46802.

Certain Tax Records are considered public record which means they are available to the public while some Tax. Search by one of the following. Show present and prior owners of the parcel.

Tax District 200.

Blackstone S 4 Billion Sale Of Las Vegas Cosmopolitan Casino Hotel Signals Rebound In Pandemic

Newspaper 2007 Nevada Tax Change Cut Cost Of Property Deals Serving Carson City For Over 150 Years

Taxpayer Information Henderson Nv

What S The Property Tax Outlook In Las Vegas Mansion Global

Taxpayer Information Henderson Nv

Taxpayer Information Henderson Nv

Clark County Nevada Property Tax Cap Facebook By Clark County Nevada Property Owners In Clarkcounty May Still File A Claim For A Primary Residential Tax Cap Rate Of 3

Clark County Clerk Opens Pop Up Marriage License Office At Airport For Valentine S 2 22 22 Wedding Rush